For decades, India was known as a nation of savers. Indian households, historically conservative with their finances, preferred the security of bank deposits and insurance plans over riskier investments. But in the last decade, a significant transformation has taken place in the financial landscape, as evidenced by the changing composition of household financial assets.

Let's dive deeper into the numbers and analyze this shift, especially the growing appeal of mutual funds.

The Decline of Traditional Savings Instruments

1. Fixed Deposits: From Dominance to Decline

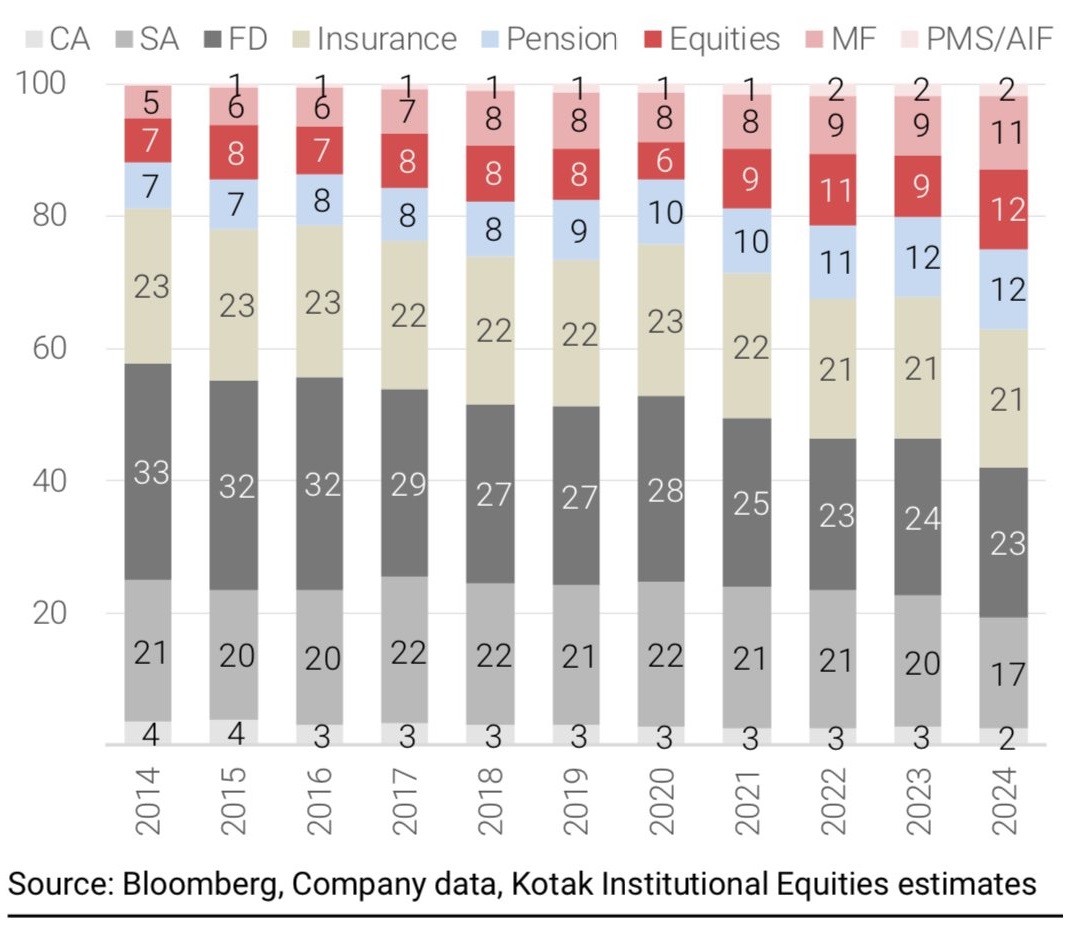

In 2014, fixed deposits (FDs) were the cornerstone of Indian household savings, comprising 33% of financial assets. FDs offered guaranteed returns with virtually no risk, making them the go-to choice for risk-averse households. However, by 2024, the share of FDs had dropped significantly to 23% , a decline of 10 percentage points.

This decline can be attributed to several factors:

- Low interest rates: The return on FDs has been steadily falling over the past decade, failing to keep pace with inflation. As a result, real returns have diminished, making FDs less attractive.

- Growing awareness of alternative investment options: With financial education initiatives and better access to information, households have become more aware of higher-return opportunities in mutual funds and equities.

2. Savings Accounts: A Gradual Decline

Similarly, the share of household financial assets parked in savings accounts (SAs) has also decreased, from 21% in 2014 to 17% in 2024. While savings accounts offer liquidity and safety, the minimal interest rates have led households to look beyond the convenience of SAs for better returns.

The Rise of Market-Linked Investments

1. Mutual Funds: Steady Growth in Popularity

In contrast to the decline in bank deposits, Mutual Funds (MFs) have seen impressive growth over the same period. In 2014, mutual funds accounted for just 5% of household financial assets, but by 2024, this figure had nearly doubled to 11%

This shift can be explained by several key factors:

- Better returns over the long term: Mutual funds, particularly equity funds, offer higher returns compared to traditional savings options, especially over a longer investment horizon.

- Systematic Investment Plans (SIPs): SIPs have revolutionized the way Indian households invest. By allowing investors to contribute small, fixed amounts regularly, SIPs make mutual fund investments more accessible and less intimidating for first-time investors.

- Awareness campaigns: Initiatives like AMFI’s “Mutual Funds Sahi Hai” campaign have played a critical role in educating the public about the benefits of mutual funds, dispelling the myths and fears associated with equity markets.

2. Equities: Growing Risk Appetite

Direct investments in Equities have also grown considerably, rising from 7% in 2014 to 12% in 2024. This trend highlights the increasing comfort Indian households are gaining with stock market investments, which were once considered too risky by many.Key drivers behind this rise include:

- The promise of higher returns: Equities have the potential for substantial capital appreciation over the long term, especially as India’s economy continues to grow.

- Technological advancements: Digital trading platforms and mobile apps have made equity investing more accessible, allowing individuals to invest in stocks with ease, even in small amounts.

- Market confidence: Over the past decade, India’s stock market has delivered strong returns, boosting investor confidence and encouraging more households to participate.

A Balanced Approach: Insurance and Pension Stability

While mutual funds and equities have gained traction, Insurance and Pension products have maintained their steady presence in household portfolios. These instruments have consistently accounted for about 22 - 23% of household financial assets from 2014 to 2024.

Insurance continues to be viewed as a necessity for long-term financial security, providing protection against unforeseen risks, while pension plans offer a stable source of retirement income. The stable allocation toward these products reflects the balanced approach Indian households are taking—pursuing growth through market-linked investments while maintaining a safety net through insurance and pension products.

Why the Shift? Key Factors Driving India’s Investment Revolution

1. Low Interest Rates on Deposits

One of the most significant factors behind the shift from deposits to market-linked investments is the decline in interest rates offered on traditional bank deposits like FDs. With inflation often surpassing FD interest rates, the real returns have eroded, pushing households to explore alternatives like mutual funds and equities for wealth creation.

2. Financial Literacy and Investor Awareness

Over the past decade, there has been a concerted effort to increase financial literacy in India. Campaigns like AMFI’s "Mutual Funds Sahi Hai" and educational initiatives by financial institutions have empowered households with the knowledge to diversify their investments. This growing awareness has encouraged more people to explore mutual funds and stock market investments.

3. Digital Revolution and Access to Investments

The rise of digital platforms and fintech innovations has democratized investing in India. Online platforms and mobile apps now allow individuals to invest in mutual funds and equities with minimal effort. Investors can manage their portfolios with just a few clicks, making the investment process more convenient and accessible than ever before.

4. Systematic Investment Plans (SIPs)

SIPs have transformed mutual fund investing, making it accessible to a broader audience. By allowing people to invest small amounts regularly, SIPs have attracted millions of retail investors who can now benefit from the long-term growth potential of equities without the need for large sums of money upfront.

The Road Ahead: India’s Investment Future

As we look forward, the trend of Indian households shifting from traditional bank deposits to mutual funds and equities is likely to continue. Several factors will play a role in this ongoing transformation:

- Growing income levels: As disposable incomes rise, households will likely allocate more of their savings toward higher-yielding investments.

- Long-term wealth-building: More individuals are recognizing the importance of long-term wealth-building strategies, such as investing in equities and mutual funds, to achieve their financial goals.

- Digital penetration: The continued rise of fintech platforms and digital investment tools will make it even easier for individuals across all demographics to participate in the markets.

- Regulatory support: India’s regulatory framework, with SEBI ensuring investor protection and promoting transparency, will continue to foster confidence in market-linked instruments.

Conclusion

India’s transformation from a nation of savers to a thriving investor economy is well underway. The decline in traditional bank deposits like FDs and savings accounts, coupled with the rise of mutual funds and equities, highlights a significant shift in the financial mindset of Indian households.With financial literacy on the rise, improved access to digital investment platforms, and the growing popularity of SIPs, mutual funds and equities are set to play an even larger role in household financial portfolios. This new approach to wealth management marks a turning point in India’s economic story, as households increasingly embrace the power of investment to grow and protect their financial future.

Disclaimer

The views expressed in this article are personal in nature and in is no way trying to predict the markets or to time them. The views expressed are for information purpose only and do not construe to be any investment, legal or taxation advice. Any action taken by you based on the information contained herein is your responsibility alone. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market including the fluctuations in the interest rates. The past performance of the mutual funds is not necessarily indicative of future performance of the schemes. The Mutual Fund is not guaranteeing or assuring any dividend under any of the schemes and the same is subject to the availability and adequacy of distributable surplus. Investors are requested to review the prospectus carefully and obtain expert professional advice regarding specific legal, tax and financial implications of the investment/participation in the scheme.